Executive Report

Prepared by research experts Hobson & Company for Rectangle Health, a leading company of healthcare technology solutions.

The Case for a Proven Healthcare Payments Solution

The digitization and consumerization of healthcare continues to accelerate. Patients increasingly expect easy access, greater choice, digital communication, and flexible, convenient payment options. In a 2020 US Bank survey*, nearly half of over 1,100 respondents say healthcare is the industry that makes payments most difficult for consumers and three quarters feel healthcare organizations’ digital payment options require modernization. Driving this belief is uneasiness about data security, as 35% reported it their top concern. At the same time, patients’ share of healthcare costs continues to rise and the ‘patient as payer’ means practices must devote many hours and resources to capturing patient payments, posting and reconciling, managing billing, protecting patient payment data, and reporting. Beyond the impact to practice growth and profitability, healthy practices must prevent burnout by making work easy for office staff and optimize their time for patient engagement to deliver the best possible healthcare experience for their patients.

Hobson & Company, a leading research firm focused on return-on-investment (ROI) studies, worked with Rectangle Health to explore these challenges. The goal of this whitepaper is to highlight examples of operational and business benefits that can be realized with Practice Management Bridge®. Hobson conducted eight in-depth interviews with Rectangle Health customers across various medical specialties to quantify the impact post-implementation. Customers found that Practice Management Bridge addressed their challenges and delivered measurable results with a strong return on investment.

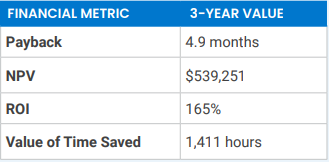

Based on the ROI analysis, an average healthcare organization would realize a return on investment of 165% from the Practice Management Bridge solution.** The goal of this research study is to highlight examples of validated use cases where the impact of the solution is not only strategic but measurable, based on key metrics confirmed by current users.

A Study Highlighting 8 Use Cases Driving Strategic and Measurable Impacts

Customers interviewed for this study noted there are consistent operational and financial challenges in managing the business side of healthcare. Below are two of the most universal concerns.

Inefficient Billing and Administrative Processes

Many practices reported using multiple, disconnected systems for patient registration, payment capture, and billing communication. This burdens staff with duplicate data entry and human errors. Reconciling payment data was cited as cumbersome for those who rely on printed reports and credit card receipts. Customers expressed frustration with manual workflows that require handling credit cards, capturing signatures, and pulling data from different sources. Practices also commonly noted processing manual overpayment refunds, generating patient statements, and chasing small balances due after insurance adjudication as time-consuming.

Protecting Practice Revenue, Cash Flow, and Profit Margin

Beyond the impact of inefficiency on practice profitability, customers noted it is challenging to grow revenue and drive cash flow without a modern, digital payment management solution. Lacking a streamlined system for payment processing, many practices find it takes too long to get paid after insurance adjudication. Delays to payment remittance strain cash flow and require extra effort to keep an eye on outstanding balances due. Practices often find the cost and effort to collect bad debt is too high, resulting in write-offs.

Customer research identified the benefits of the Practice Management Bridge solution across two broad business objectives:

- Improve operational efficiency

- Increase collections

This research paper highlights eight use cases of Practice Management Bridge that help improve operational efficiency and increase collections.

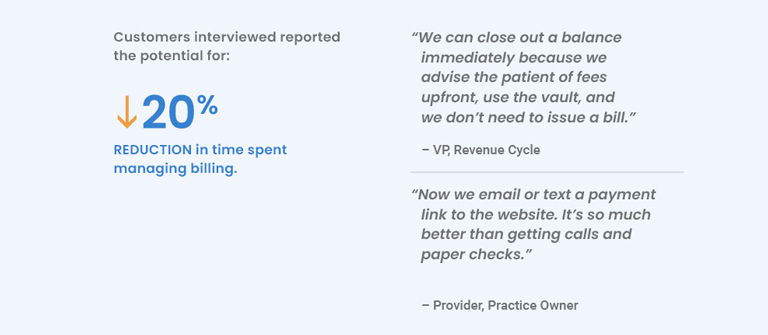

1. Reduce time spent on payment collection and posting.

Healthcare organizations interviewed confirmed that Practice Management Bridge offers tools to optimize staff time at all stages of the patient billing cycle; including Card on File and pre-authorization forms to reduce the number of invoices sent; recurring payments to eliminate paper payments; online payments to decrease calls to the office; and Text-to-Pay links and digital receipts for patients to further increase staff efficiency.

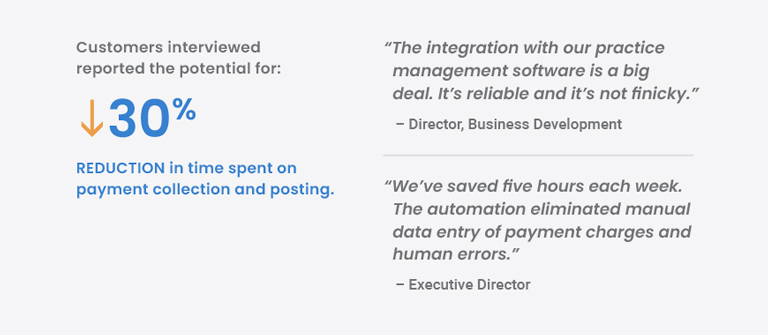

2. Reduce time spent on payment collection and posting.

Customers interviewed agreed that Practice Management Bridge helped speed up the payment workflow with digital tools to drive self-payments and contactless payments, Card on File with pre-authorized payment agreements to expedite checkout and capture post-adjudication balances, and automated payment posting to reduce keystrokes and data entry errors.

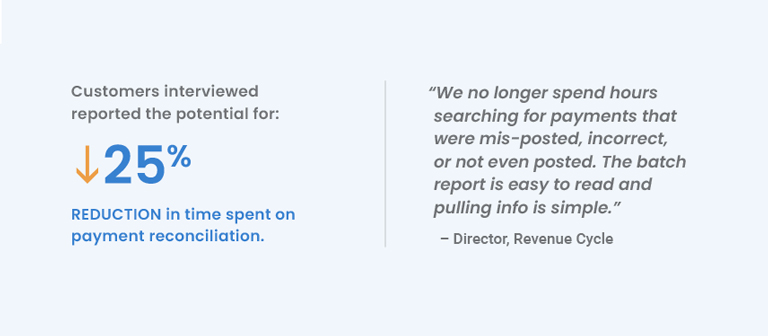

3. Reduce time spent on payment reconciliation.

Customers interviewed confirmed that Practice Management Bridge is a single, secure platform that allows staff to manage the office from anywhere, anytime. It facilitates efficient reconciliation, saving time and paperwork through end-of-day batching and centralized reporting, and eliminates errors by automating payment data into the practice management system.

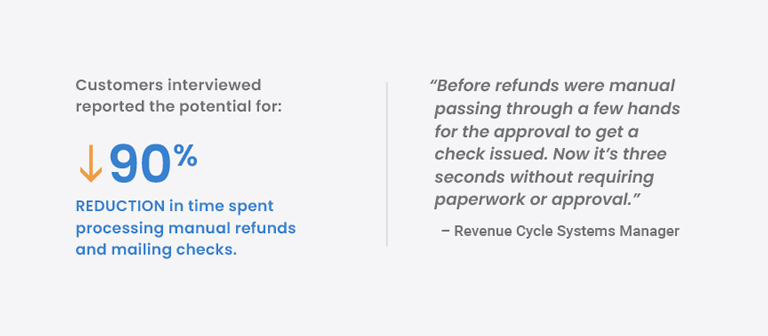

4. Reduce time spent processing manual refunds and mailing checks.

Healthcare organizations interviewed reported complete relief from the onerous task of managing manual overpayment refunds. Practice Management Bridge enables staff to search for, void, and refund transactions, email a receipt, and return patients money quickly and easily in a few clicks.

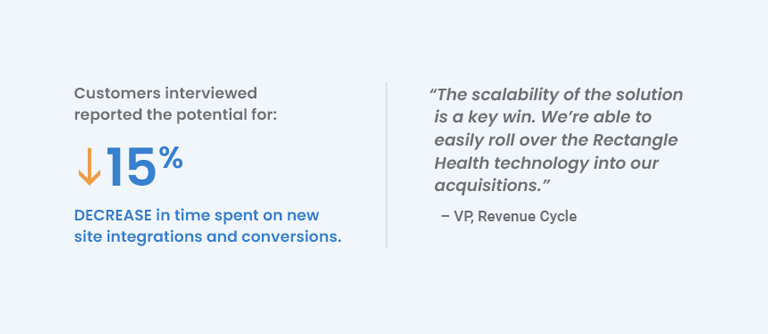

5. Reduce time spent on new site integrations/conversions.

Medical office mergers and practice acquisitions present immediate operational challenges to healthcare organizations. Customers interviewed confirmed that Practice Management Bridge is easy to implement with remote installation enabling visibility and control across the entire enterprise. The seamless interface with any practice management or billing system facilitates a consistent workflow and centralized reporting.

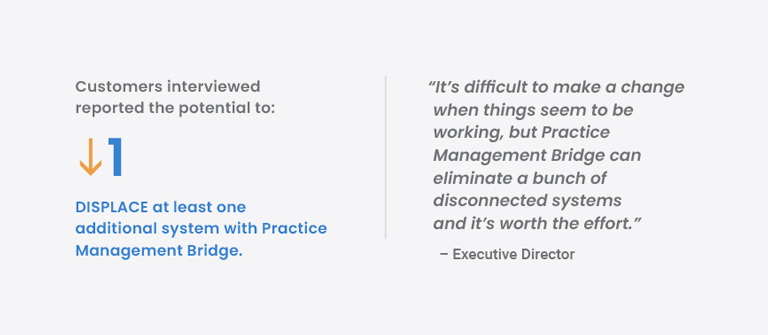

6. Consolidate systems into one payments solution across multiple sites.

Practice Management Bridge standardizes workflows and reporting across an entire organization and automates daily data posting for every location back into the practice management system. The online, cloud-based solution enables consistent in-office and out-of-office bill pay, patient registration, a single payment hub, and advanced reporting tools.

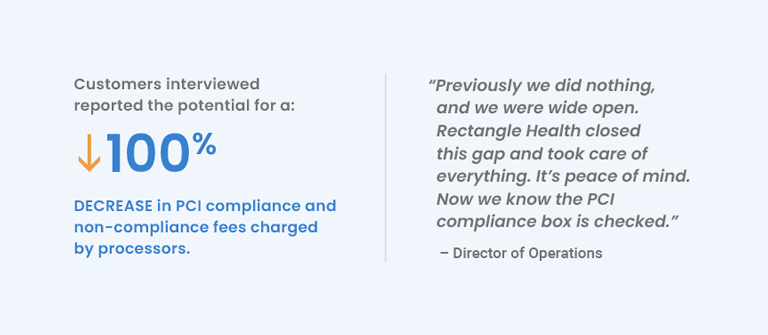

7. Reduce cost of PCI compliance and non-compliance fees.

Healthcare organizations must comply with regulations to keep patient data safe. Customers interviewed confirmed that Practice Management Bridge enables secure payment processing and keeps data safe in an encrypted vault protected by layers of technology that provides peace of mind and enables demonstration of PCI compliance, compliance with standards, and the ability to meet reporting requirements.

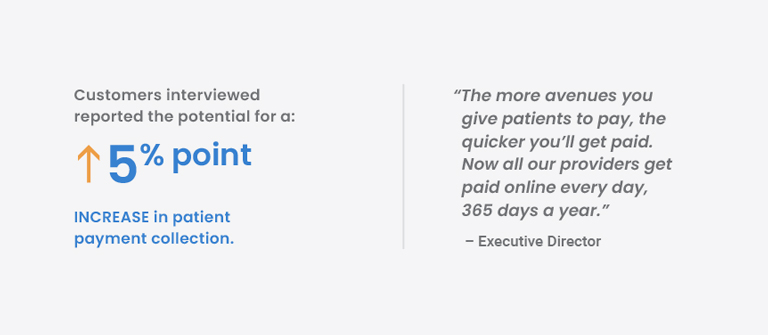

8. Improve patient payment collection.

For healthcare organizations, Practice Management Bridge can facilitate increased payment capture to ensure patient payments are made in full. Customers interviewed confirmed the solution’s wide array of digital tools and payment options speed up and improve the likelihood of payment. Online payments provide convenience while recurring payments offer affordability. Digital pre-registration enables practices to communicate payment expectations and responsibility upfront. Comprehensive reporting provides visibility so practices can keep an eye on outstanding balances, while custom Text-to-Pay messages can drive effortless collection of small balances due that can be costly to collect.

Summary of the ROI Findings

The value of Practice Management Bridge is immediate and demonstrable. A total of eight benefits were identified during customer interviews for this research paper. Below is a sample of the top four benefits and their potential three-year value to a healthcare organization that operates five offices, processes $400K monthly, generates 3.5K patient statements each month, and collects 90% of outstanding patient balances.

For the sample healthcare organization, Practice Management Bridge generates positive cash flow in 4.9 months. The annual benefit from increasing collections could be as much as $240K with annual benefits exceeding $362K overall. The three-year net present value (NPV) and return on investment (ROI) are strong at $539K and 165%, respectively. The financial metrics for this study were calculated using standard financial modeling methods.

About Rectangle Health

Rectangle Health, a leading healthcare technology company, empowers medical, dental, and specialty practices with seamless and secure technology to drive revenue by increasing patient payments and streamlining practice management and payment processing. Since 1993, the company’s innovative solutions have reduced administrative burden and rebalanced the ledger for its thousands of healthcare providers in the U.S., reliably processing billions of dollars in payments annually. For more information, please visit www.rectanglehealth.com.

About Hobson & Company

Hobson & Company helps technology vendors and purchasers uncover, quantify, and validate the key sources of value driving the adoption of new and emerging technologies. Our focus on robust validation has helped many technology purchasers more objectively evaluate the underlying business case of a new technology, while better understanding which vendors best deliver against the key value drivers. Our well researched, yet easy to use ROI and TCO tools have also helped many technology companies better position and justify their unique value proposition. For more information, please visit www.hobsonco.com.

References

* 2021 Healthcare Payments Insight Report, US Bank, 2021.

** An average organization has 5 offices, processes $400K and generates 3.5K patient statements monthly and collects 90% of patient balances

Disclaimer: The return-on-investment (ROI) and other financial calculations performed by this tool are based on data provided by Rectangle Health customers and various assumptions and estimates only. The actual ROI realized by customers may vary from the estimates provided. Rectangle Health and Hobson & Company (the firm that created the tool) are not responsible for the accuracy of any estimates. No part of this publication may be reproduced or transmitted in any form or by any means, electronic or mechanical, including photocopying, recording or any retrieval system, without the written permission of the copyright holder.

© Hobson & Company, 2022. All rights reserved. All other marks are the property of their respective owners.