Part one of a two-part series. Click here for part two: How to automate AR.

Healthcare accounts receivable spans payer reimbursement and patient payments. When either side slows down, revenue stalls — and when both are manual, delays snowball.

That’s why healthcare organizations are turning to automated accounts receivable (AR): not as a back-office upgrade, but a smart way to keep payer and patient payments moving in sync.

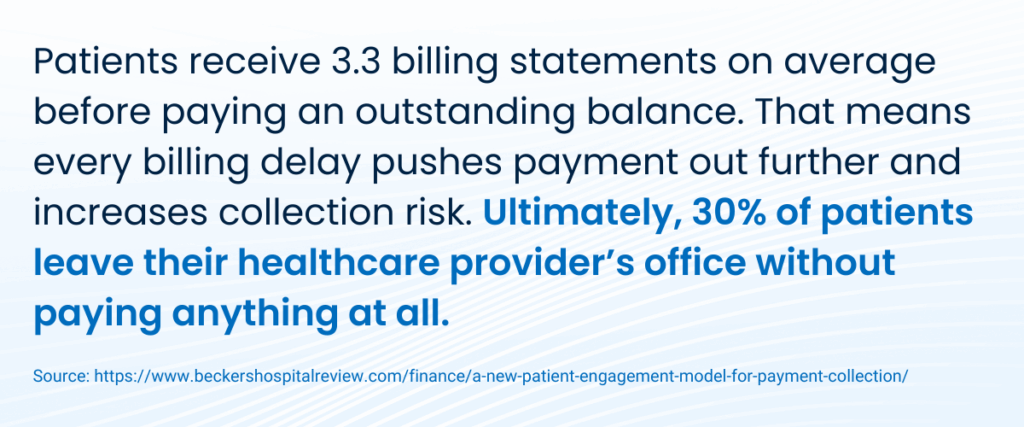

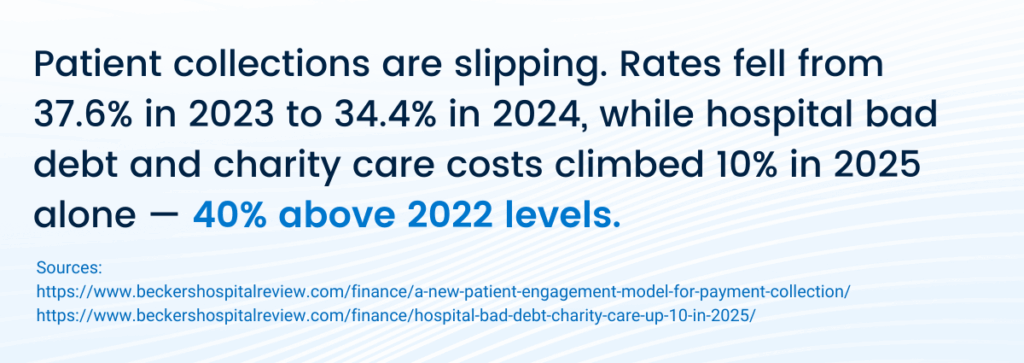

Patient responsibility now accounts for 30% of provider revenue, jumping up from less than 10% in 10 years. This is largely driven by the rise of high-deductible health plans and increasing out-of-pocket costs.

At the same time, payer behavior is becoming less predictable. As a result, healthcare staff are feeling the squeeze — spending more and more time doing manual reconciliation, correcting errors, and investigating unclear balances.

It used to be that one of the biggest risks of manual AR processes was the time is consumed, but now, the stakes are higher. Here are six reasons why automated AR is no longer optional.

1. Payer unpredictability breaks handoffs to patient billing

With funding less predictable and regulations constantly evolving, payers are finding that manual financial processes can’t keep up.

Providers have to manage the downstream consequences.

Payments arrive through different channels, like ACH, virtual card, and check, often with remittance data delivered separately or in an incompatible format.

Say, for example, your practice received funds from a given insurance provider on Monday, but the EOP doesn’t arrive until Wednesday. That leaves billing staff with two choices:

- Fill gaps with guesswork to post on time — but with incomplete information.

- Wait until the EOP shows up, slowing the whole process down.

When payer payments aren’t posted quickly and accurately, you can’t bill patients. Their responsibility is unclear, statements stall, and by the time you do bill them, they may not pay at all.

What starts as a delay from the payer ends as an inability to collect. The situation worsens as market conditions make payer behavior less and less predictable, stacking bad debt on top of bad debt.

But remittance timing is only part of the problem.

Payers may unexpectedly reimburse virtual cards, which can interrupt standard manual workflows. And with EOP formats varying by payer, staff have to interpret and standardize each one individually before posting.

When your team is backlogged with busywork determining whether open balances are unpaid, incorrectly posted, you need a system that can handle that complexity automatically.

2. Patient payment delays make outstanding AR worse

Automated AR isn’t just about processing insurance faster — it’s about tightening the handoffs between payers and patients, so collections happen while care is still top of mind. When those handoffs are delayed, patient payments don’t just slow — they vanish.

Statements often go out weeks after care, once insurance posting finally catches up. Patients receive multiple bills with changing balances, eroding trust and confidence in what they owe. Meanwhile, staff are left chasing payments without clear context or reliable data — turning what should be a straightforward collection into a time-consuming guessing game.

Neither payer nor patient balances are clear, and revenue remains uncertain. And once patient billing is delayed, recovery becomes exponentially harder—regardless of staff effort.

3. Payment posting determines revenue reliability

Until a payment is posted, it just doesn’t exist in your accounts receivable system. Even when funds have cleared, accounts can still appear unpaid. And when your office staff go to follow up, most often, they have to do it without the full context. Patient billing then gets delayed, not because insurance hasn’t paid, but because the payment hasn’t actually been processed.

Manual posting introduces risk into every transaction. For example, if a payment is applied to the wrong account, there’s no immediate visibility. Also, EOPs can easily become separated from the payments they belong to.

Small documentation gaps might seem minor as they arise, but they become significantly harder to trace and correct weeks or even months later.

Without automated AR, posting errors compound over time, making it impossible to trust what’s truly collectible — and your revenue data unreliable.

4. Accurate posting and real-time data drive better decisions

When posting lags behind payments, leadership is forced to make forecasting, staffing, and planning decisions based on inaccurate and incomplete AR reports.

Automated posting keeps AR data current and accurate, transforming it from a backward-looking record into a real-time management tool that lets you plan with confidence.

5. Higher patient responsibility raises the stakes

As patient balances represent an increasingly large portion of total revenue, every delay on the payer side directly affects speed of patient-side collection — or whether you can collect at all. When insurance payments aren’t finalized quickly, you can’t determine patient responsibility, and you certainly can’t bill them.

When payer delays push patient billing out by weeks, patients are far less likely to pay. So, payer-side collection lags morph what should have been collectible revenue into bad debt. Automating payer processing is the way to close the gap that leads to lost revenue.

It tightens the timeline between insurance payment and patient billing so patients are billed while the service is still recent and they still have intent to pay.

6. Today’s teams don’t have time for manual rework

In 2026, manual AR assumes practices have enough staff capacity to spend all day every day investigating discrepancies, reconciling accounts, and correcting errors as they arise. Staffing constraints, turnover, and burnout mean that rework creates backlogs that not only feed on themselves, but are harder to resolve as time goes on.

Even worse, each unresolved issue increases the likelihood of another, and staff gets pulled further away from the actual work that moves your revenue forward.

The volume of exceptions hasn’t decreased, and the capacity for teams to handle those exceptions manually has shrunk.

When routine transactions happen automatically and exceptions are surfaced early, staff can address issues proactively — rather than spending hours investigating problems that should never have even happened.

Manual AR can’t keep up with today’s revenue realities

The biggest challenge facing healthcare revenue cycles today is uncertainty.

Teams that still rely on manual processes have the decks stacked against them: Payer unpredictability, higher patient responsibility, and operational constraints have made delay and ambiguity intolerable.

Manual AR introduces even more uncertainty at every point, even when teams are working hard and performing at their best.

Accounts receivable automation has shifted from an efficiency gain to an operational necessity.

When payer reimbursements and patient payments are captured, reconciled, and posted reliably and accurately — and automatically — AR data becomes trustworthy and revenue becomes predictable.

If your AR team feels like they’re struggling to keep up or they’re working harder than ever but the results aren’t improving, then the process itself is likely the constraint. These challenges aren’t going away any time soon.

The smart solution is to adopt systems that can handle the complexity of healthcare payments and stay reliable when manual processes can’t.

Ready for part two of this series? Click here to read it now.

How close is your practice to smart collection?

See how far your current AR processes have progressed — and where automation can unlock smarter, faster collections. Get a clear, no-pressure view of how payments move through your organization today with our fast, free AR checkup.