As professionals in the cosmetic dentistry field, you know firsthand the immeasurable value that patients receive when they invest in a smile that they want to share with the world. Veneers, crowns, implants, teeth whitening, and bridges have the power to wholly transform a person’s confidence and quality of life. But this payoff often comes at an unavoidably high price, due to the specialized services that cosmetic dentists provide, the materials used, and the additional professionals involved in changing raw material into a smile-transformer.

While non-cosmetic dental work is often covered, insurance companies do not provide the same level of coverage to patients seeking cosmetic dental work, because of the elective nature of many cosmetic procedures. Without the assistance of traditional dental insurance coverage, and unless they are enrolled in a comprehensive full-coverage dental plan, many patients are left wondering how they can possibly afford cosmetic dental services.

Unfortunately, the price of treatment and involvement from insurance companies might be out of your control. However, you do have the power to help your patients confidently elect care by sharing tips and programs to make their treatments more affordable. From third-party financing companies to in-house financing choices that are available through your practice, patients have options when it comes to paying for the services that they want, and you sharing those options with patients can make the difference in whether or not they choose to receive care from your practice.

Equipping patients with knowledge and flexible payment options is not only good for your patients, but also for your practice, as more patients can choose to begin treatment than would be able to otherwise. Learn more about the common financial options that are available to patients for cosmetic dentistry and empower more patients to say “yes” to a smile that they feel great about.

Option #1: Traditional Credit Card

Paying for cosmetic dental services using a traditional credit card is a viable option for patients who are comfortable doing so. Before choosing this option, patients should refresh themselves on their credit limit and interest rate and have a plan in place for paying the balance off. Many credit cards offer an 0% introductory APR period for newly opened accounts. If patients plan to pay off their balance within the covered amount of time, opening a new account can be a wise choice for those whose credit score is in the approved range.

Option #2: Healthcare Credit Card

Healthcare credit cards function very similarly to traditional credit cards, but they can be used only for approved healthcare-related expenses. These approved expenses can cover a wide range of health services, from surgery to a spa treatment, and cosmetic dentistry is included as an authorized category by major card carriers.

Many of the most popular healthcare credit cards, such as CareCredit, pay the dentist upfront and require a standing contract with the practice and a percentage fee taken from each payment. Patients must apply and be approved to open a healthcare credit card, which includes passing a credit check, and their credit score can be affected in the same way as if they were to open a traditional credit card. Patients make payments to the credit card provider to pay off the balance owed. These specialty credit cards typically offer patients a generous interest-free window within which to make their payments, but beyond that window, the interest fees are above average.

Option #3: Flexible Financing Options

There are certainly benefits, for both patients and dentists, to directing patients to the outside financing options described above. Some dentists are more comfortable referring their patients to outside companies to collect balances, and some insist on receiving full payment upfront. However, there are also numerous benefits to creating a program at your practice for flexible in-house financing.

An in-house financing program can be offered either as the only financing option at your office, or in addition to any of the payment routes mentioned above. Flexible payment plans offered to patients directly from your practice are a practical tool to strengthen the provider-patient relationship, increase loyalty to your practice, and attract new clientele. Patients who are happy with your available financing options to afford their care are likely to refer additional patients.

By keeping financing in-house, you have more control over the patient experience as you work directly with your patients rather than referring them to a separate entity. Beyond this level of involvement, installment payments bolster a practice’s business model by bringing in additional revenue stream of smaller, consistent payments. Over time, these monthly payments add up to be dependable and significant revenue.

Option #4 Health Savings Account, Flexible Spending Accounts, and Healthcare Reimbursement Accounts

These special healthcare funding accounts, like insurance, have limitations on what they will and will not cover, but they are a useful option and preferable option for qualifying expenses. Treatments that are completed for strictly aesthetic purposes are typically not eligible to use these types of funds, but if there is a proven, health-related need for a procedure, the treatments can be eligible for reimbursement from these tax-free accounts.

HSAs, FSAs, and HRAs are growing in popularity because of the financial benefits and flexibility they offer patients, and it is worthwhile to remind your patients to look into the terms of their specific plan to see if they can leverage their funds to either pay for their services or to reimburse their bank accounts.

Option #5: Third-party Financing

There are several third-party financing companies that cater to cosmetic dental practices and patients seeking elective dental treatments. Third-party financing companies typically form partnerships with practices, and interested patients are referred from the practice to the financing company. Patients are required to apply and pass a credit check. For patients who are approved, funding is provided either through an installment loan for a one-time treatment or a revolving line of credit for ongoing procedures.

These companies offer multiple arrangement offerings and payback terms, so if you decide to refer your patients to a third-party financing company, there are a couple of key considerations. Make sure that you are comfortable with the cut of revenue that the program will take from your practice and also with associating your practice with the program that will be offered to your patients.

Option #6: Cosmetic Dentistry Grant

If you have patients who are able to wait to begin their treatments, consider sharing information about the Cosmetic Dentistry Grants program with them. The grant provides funding for a number of cosmetic procedures, including veneers, implants, Invisalign, teeth whitening, contouring, and more. The application process involves proving eligibility and undergoing a professional assessment to affirm the need for services and the overall health of the patients’ mouth.

Anyone seeking cosmetic dental treatment is invited to apply for a grant, but it is a competitive program, and candidates who can prove that they have a legitimate need for the cosmetic services have a higher chance of being approved. While this financing route isn’t a guarantee for patients, it is free to apply, and many patients who have a dire need for services will find it worthwhile to do so.

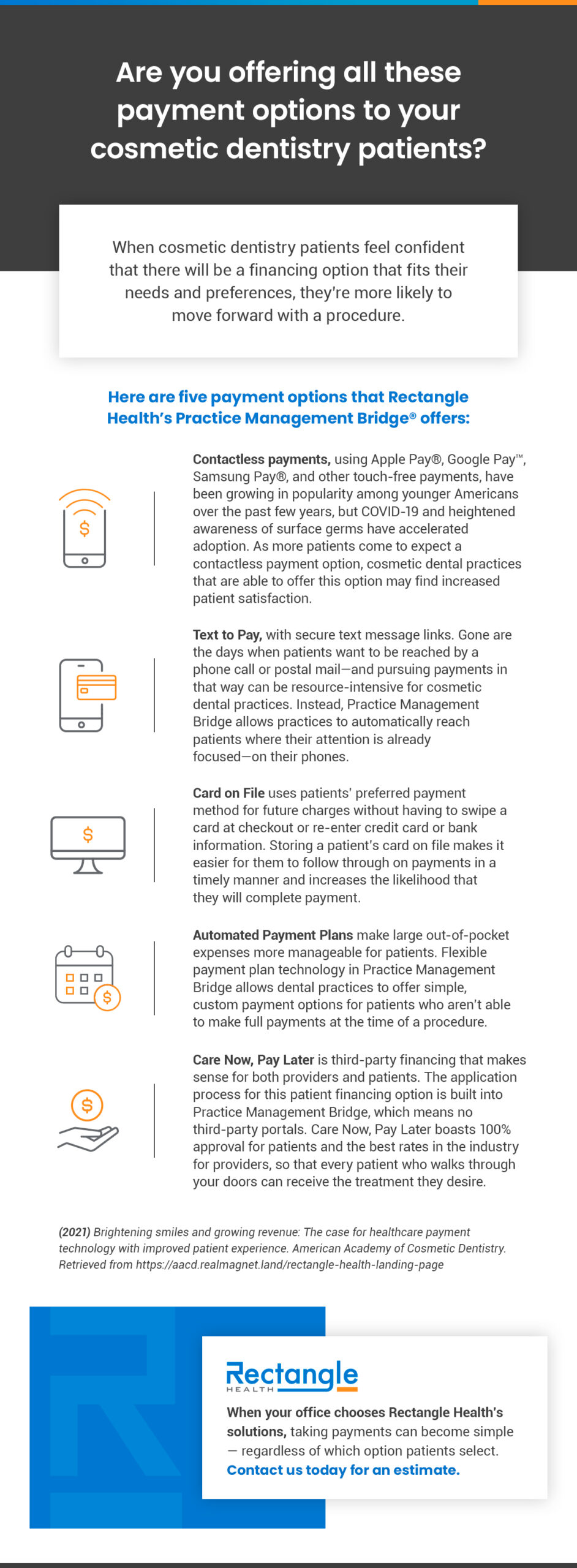

Discover Cosmetic Dentistry Payment Solutions with Rectangle Health

A leading healthcare technology company, Rectangle Health, believes that no patient should have to opt out of dental care, whether medically necessary or cosmetic, because of the cost. True to our mission of making it easier and faster for providers to get paid, our technology is equally beneficial for the dentist, too. Our Practice Management Bridge® payment platform uses automatic recurring payments to take the manual upkeep out of installment plans. With a card securely stored on file and a Pre-Authorized Healthcare Form signed upfront, cosmetic dentistry offices simply schedule payment arrangements before or at the time of service, and their patients are billed in weekly or monthly increments for a pre-determined amount that leaves both parties smiling.

Third-party financing, with favorable terms for both patients and providers, is also available through the patient financing option in Practice Management Bridge. Applications for patient financing begin right inside Practice Management Bridge. This solution takes financing off of the hands of dental providers, and application does not impact patients’ credit.

Beyond financing, we offer every way for patients to pay from in-office card readers to contactless payments, as well as online and mobile payments.

Whether you choose to communicate outside financing options to patients, partner with third-party financing companies, or provide in-house payment plans, cosmetic dentistry can be made more affordable for more patients given these multiple payment options. Thanks to the various financing avenues available today, cosmetic dentists can perform their life-enhancing work for an expanded patient pool. An understanding of the different types of payment options that are available, and the ability to choose the best fit, can be all that stands between patients and the cosmetic services that they’ve been dreaming of.