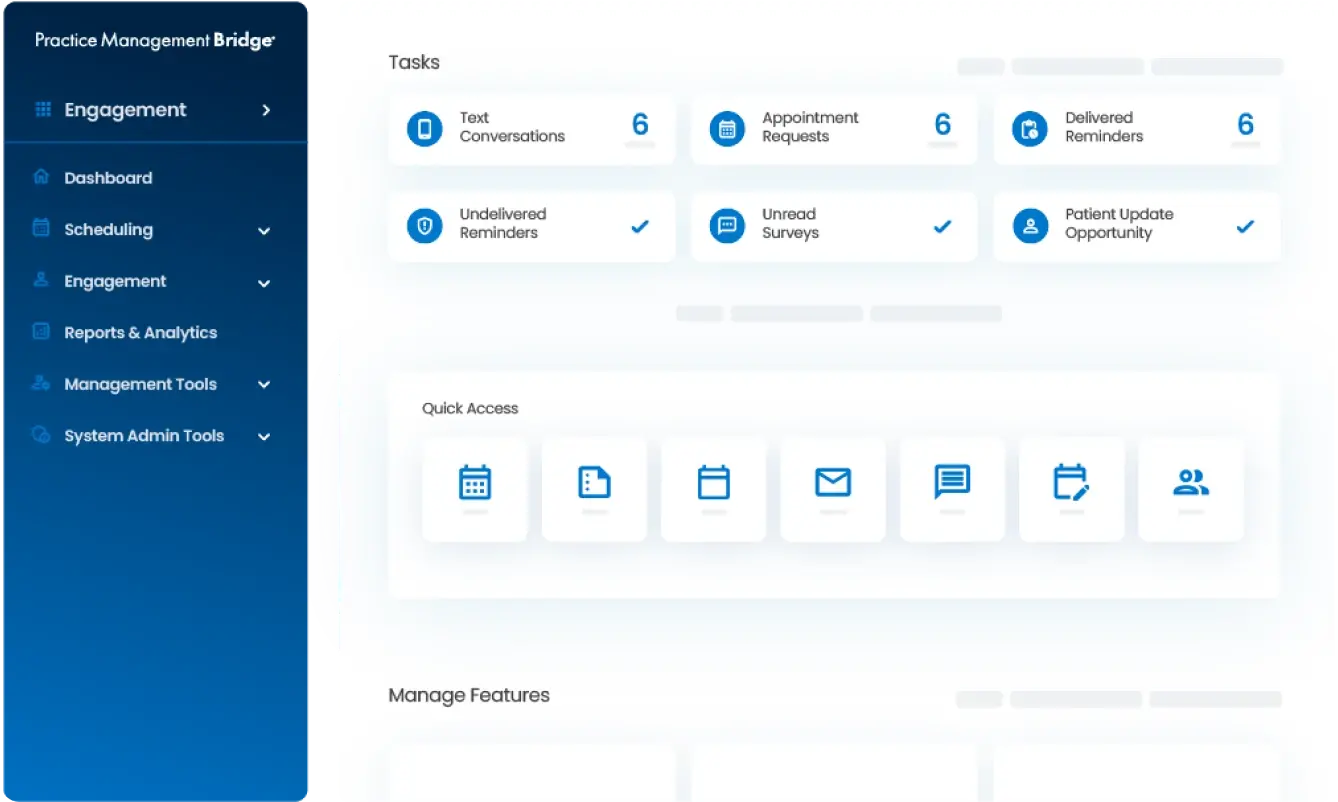

We’re taking productivity to new heights.

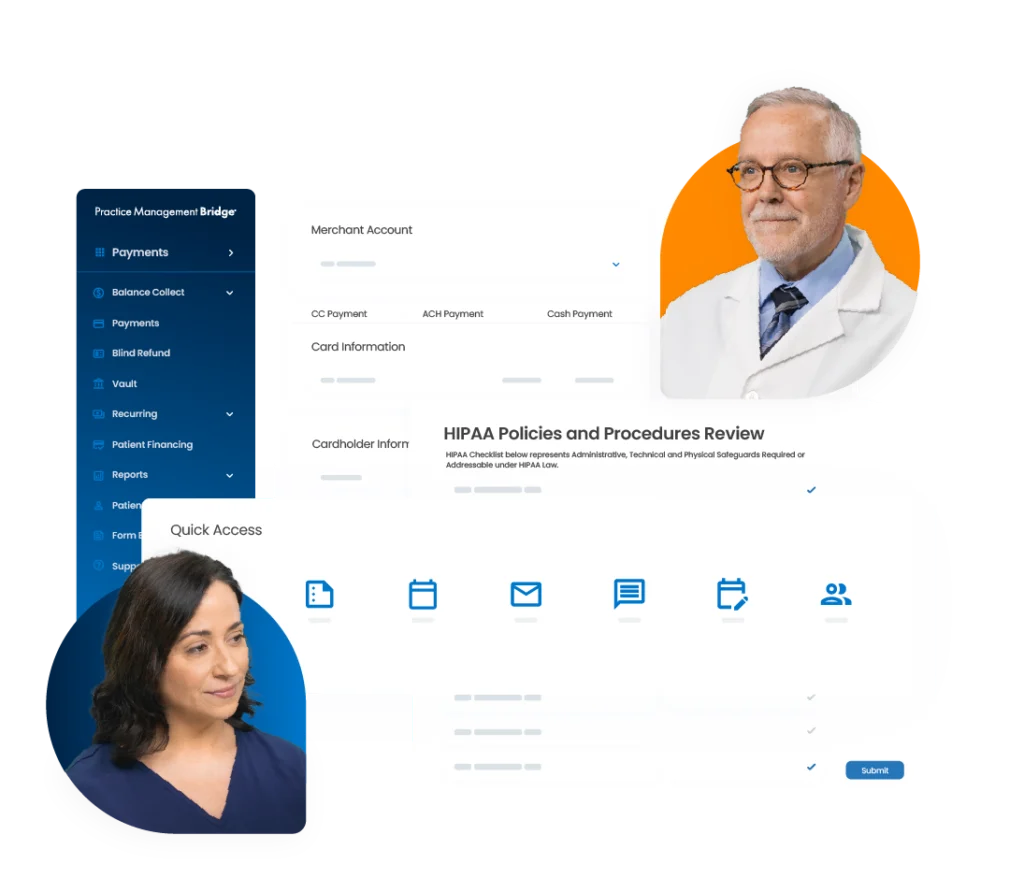

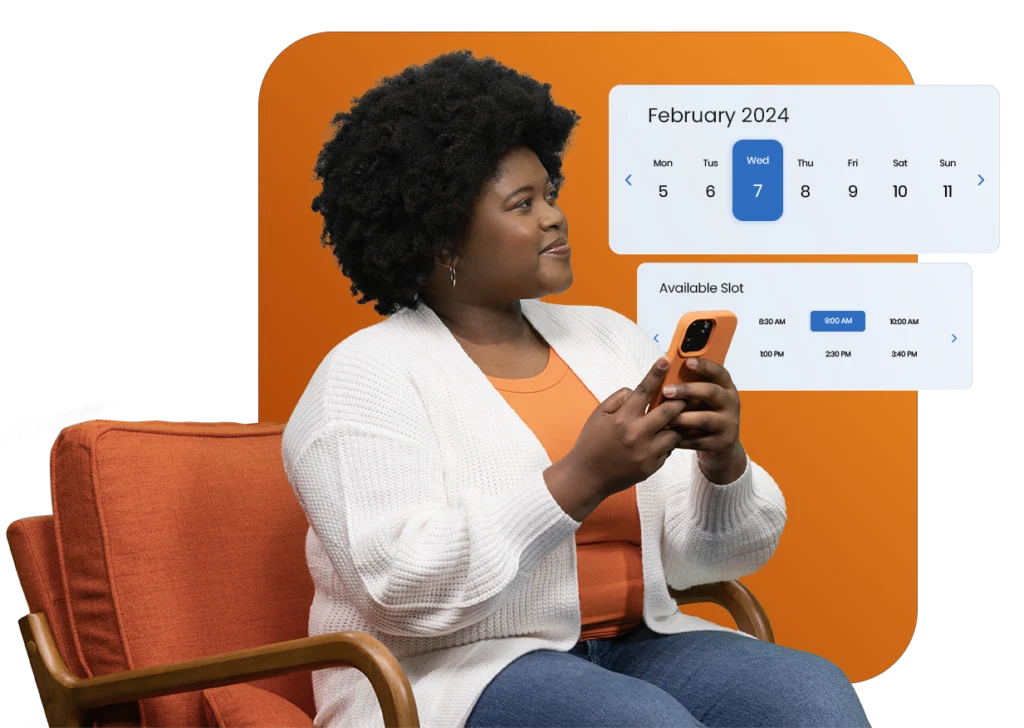

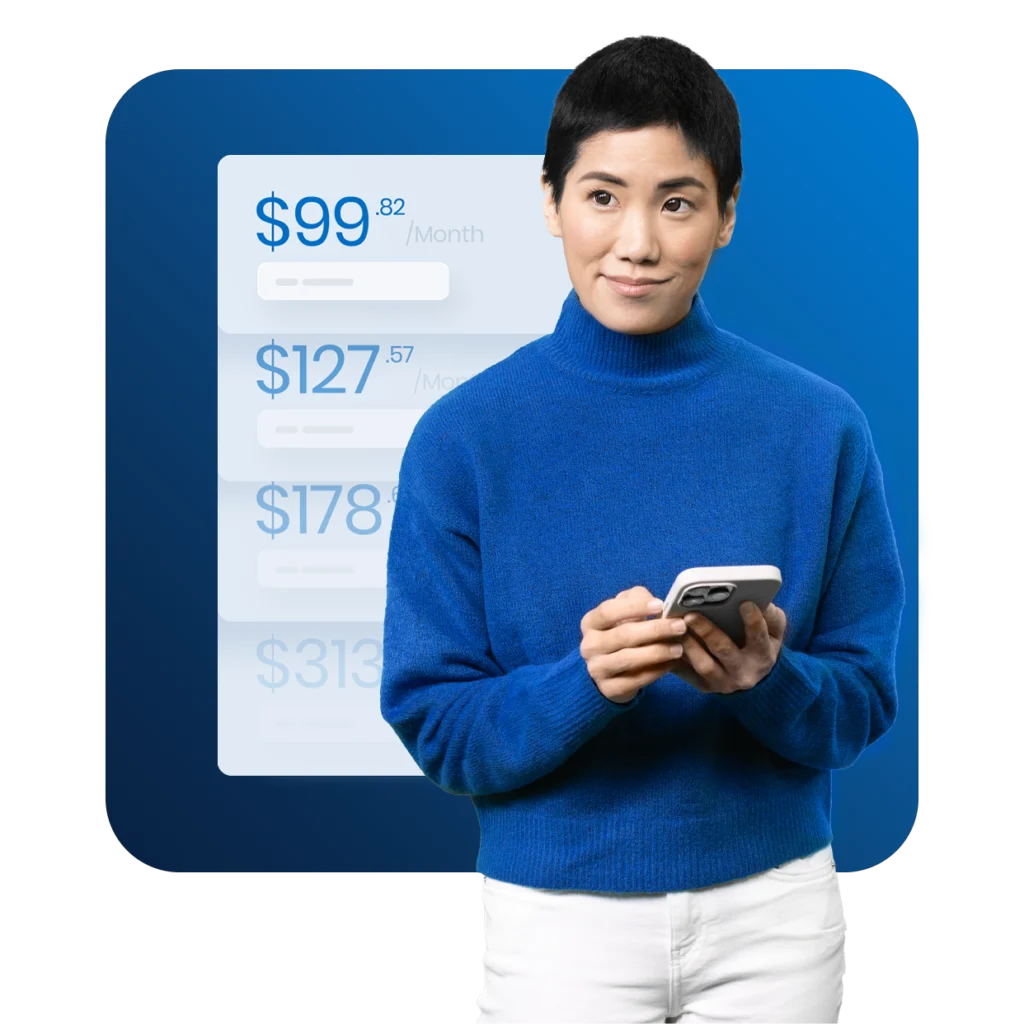

Practice Management Bridge is an easy-to-implement and easy-to-use software designed to automate day to day operations – from payments to compliance and staying in touch with patients. Even better, we connect to other technology providers, boasting PMS-agnostic functionality and direct integrations to drive more revenue and create incredible efficiencies.